WESTLOCK – Lockstep with recently-passed legislation by its urban neighbours, Westlock County has enacted a municipal tax incentive bylaw which offers three years of tax relief for new builds and renos and tops out with a 100 per cent rebate in Year 1 for projects above $1 million.

Councillors discussed the new Bylaw 49-2023 Non-Residential Property Tax Incentive for close to 30 minutes at their Aug. 15 committee of the whole (COW) meeting, them unanimously passed the eight-page document later that afternoon at their regular meeting — administration first brought the idea of a tax incentive bylaw to council at its July 18 COW meeting.

Councillors spent most of the debate cleaning up the wording of the edict, which includes the rebate application form, before its final passage and said this is a good start to drive more economic development throughout the Westlock area.

“This is just our whole point of allowing our residents to be able to increase their businesses with a little bit of cushion,” said reeve Christine Wiese. “The whole point is to help increase business, not make money off it. It’s to promote people to stay in Westlock County and improve their businesses. This is something we heard at the open houses, so I think this is another case of us listening to residents.”

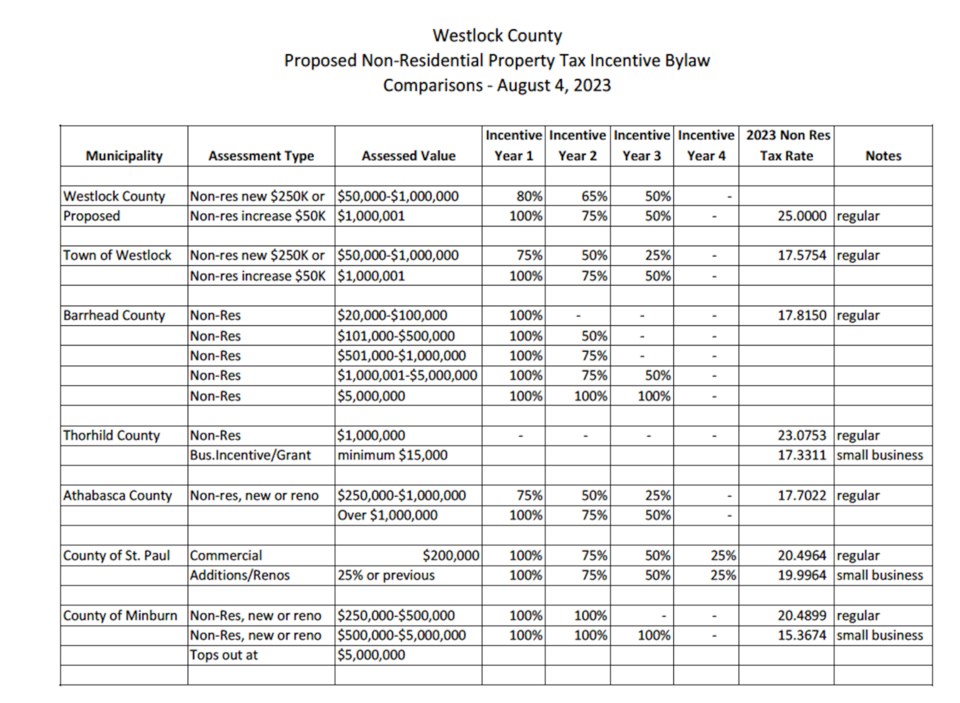

In a follow-up interview, as well as throughout the meeting, CAO Tony Kulbisky made it clear that their bylaw needed to closely mimic the town’s recently-passed tax incentive bylaw as there are “differences in the actual tax rate structure for non-residential development between the two” so they needed to tweak the percentages to ensure “we are parallel with the town.”

"If we’re working together on the regional economic development committee, we need to hunt as a pack. So, it doesn’t make any sense to have a tax incentive bylaw that’s different from other municipalities within the region,” said Kulbisky. “We needed to be as close as we could, but making sure we had a bylaw that makes sense for Westlock County, but also mimics closely what other municipalities are doing in the region.

“Honestly, it’s going to bode well for everybody if we can show that we’re presenting a common front.”

Going forward, new non-residential builds or renos from $50,000 up to $1 million get an 80 per cent tax bill reduction in the first year, 65 per cent in the second year and 50 per cent in Year 3 — for renos, the rebate is applied only to the “increased assessment amount” of the project.

While Coun. Stuart Fox-Robinson, as well as several other councillors, called into question the $50,000 floor as possibly being too low, he did say “having this is better than not having it.”

“We don’t know how successful this is going to be, but we have to start somewhere. So, I think this is something that we monitor how it goes and if it becomes a major problem we’ll bring it back to council for further discussion,” said Kulbisky. “I agree that it’s low, but we were trying to mimic what the other municipalities in the region are doing. Maybe this is a discussion that continues at tri-council.”

Projects over $1 million get a 100 per cent tax rebate in the first year, 75 per cent in the second and 50 per cent in the third — the rebate for renos or new builds only applies to the municipal tax portion of a ratepayers’ bill.

Wiese also noted that some municipalities are offering tax incentives for homeowners to do renos and said that’s something they may want to eventually consider. Following the passage of Bill 7, the Municipal Government (Property Tax Incentives) Amendment Act, back in 2019, specifically Section 364.2, allows municipalities to grant full, or partial, tax exemptions and tax deferrals to non-residential properties.

“There’s a lot of room to grow and it’s something we may want to talk to other people in the region as well. But this is definitely a good start,” Wiese added.