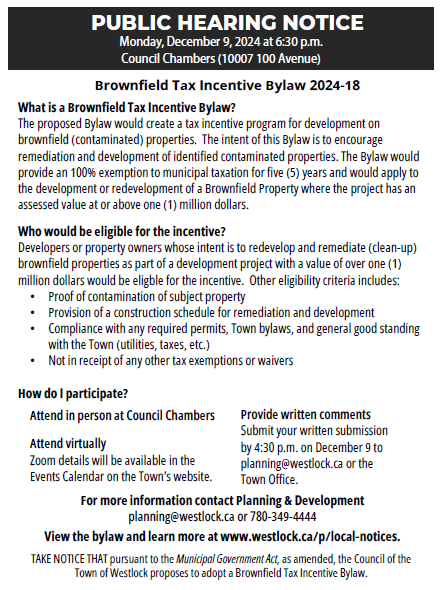

Monday, December 9, 2024 at 6:30 p.m.

Council Chambers (10007 100 Avenue)

Brownfield Tax Incentive Bylaw 2024-18

What is a Brownfield Tax Incentive Bylaw?

The proposed Bylaw would create a tax incentive program for development on

brownfield (contaminated) properties. The intent of this Bylaw is to encourage

remediation and development of identified contaminated properties. The Bylaw would

provide an 100% exemption to municipal taxation for five (5) years and would apply to

the development or redevelopment of a Brownfield Property where the project has an

assessed value at or above one (1) million dollars.

Who would be eligible for the incentive?

Developers or property owners whose intent is to redevelop and remediate (clean-up)

brownfield properties as part of a development project with a value of over one (1)

million dollars would be eligible for the incentive. Other eligibility criteria includes:

• Proof of contamination of subject property

• Provision of a construction schedule for remediation and development

• Compliance with any required permits, Town bylaws, and general good standing

with the Town (utilities, taxes, etc.)

• Not in receipt of any other tax exemptions or waivers

How do I participate?

Attend in person at Council Chambers

Attend virtually

Zoom details will be available in the

Events Calendar on the Town’s website.

Provide written comments

Submit your written submission

by 4:30 p.m. on December 9 to

[email protected] or the

Town Office.

TAKE NOTICE THAT pursuant to the Municipal Government Act, as amended, the Council of the

Town of Westlock proposes to adopt a Brownfield Tax Incentive Bylaw.

For more information contact Planning & Development

[email protected] or 780-349-4444

View the bylaw and learn more at www.westlock.ca/p/local-notices.