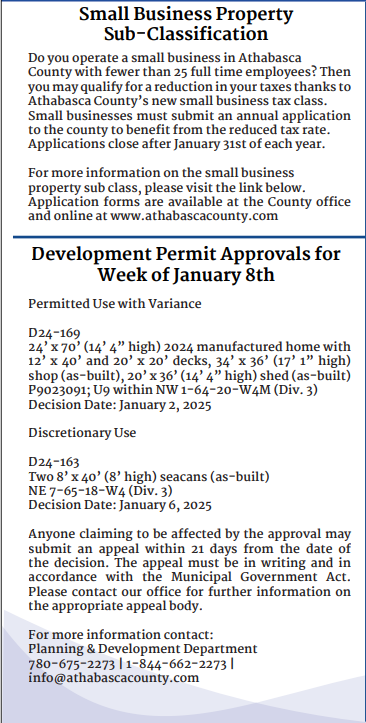

Small Business Property Sub-Classification

Do you operate a small business in Athabasca County with fewer than 25 full time employees? Then you may qualify for a reduction in your taxes thanks to Athabasca County’s new small business tax class. Small businesses must submit an annual application to the county to benefit from the reduced tax rate. Applications close after January 31st of each year. For more information on the small business property sub class, please visit the link below. Application forms are available at the County office and online at www.athabascacounty.com

Development Permit Approvals for Week of January 8th

Permitted Use with Variance D24-169 24’ x 70’ (14’ 4” high) 2024 manufactured home with 12’ x 40’ and 20’ x 20’ decks, 34’ x 36’ (17’ 1” high) shop (as-built), 20’ x 36’ (14’ 4” high) shed (as-built) P9023091; U9 within NW 1-64-20-W4M (Div. 3) Decision Date: January 2, 2025 Discretionary Use D24-163 Two 8’ x 40’ (8’ high) seacans (as-built) NE 7-65-18-W4 (Div. 3) Decision Date: January 6, 2025 Anyone claiming to be affected by the approval may submit an appeal within 21 days from the date of the decision. The appeal must be in writing and in accordance with the Municipal Government Act. Please contact our office for further information on the appropriate appeal body. For more information contact: Planning & Development Department 780-675-2273 | 1-844-662-2273 | [email protected]