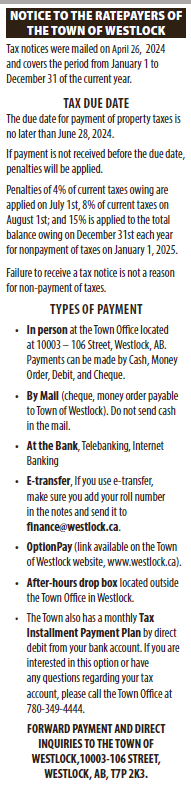

Tax notices were mailed on April 26, 2024

and covers the period from January 1 to

December 31 of the current year.

TAX DUE DATE

The due date for payment of property taxes is

no later than June 28, 2024.

If payment is not received before the due date,

penalties will be applied.

Penalties of 4% of current taxes owing are

applied on July 1st, 8% of current taxes on

August 1st; and 15% is applied to the total

balance owing on December 31st each year

for nonpayment of taxes on January 1, 2025.

Failure to receive a tax notice is not a reason

for non-payment of taxes.

TYPES OF PAYMENT

• In person at the Town Office located

at 10003 – 106 Street, Westlock, AB.

Payments can be made by Cash, Money

Order, Debit, and Cheque.

• By Mail (cheque, money order payable

to Town of Westlock). Do not send cash

in the mail.

• At the Bank, Telebanking, Internet

Banking

• E-transfer, If you use e-transfer,

make sure you add your roll number

in the notes and send it to

• OptionPay (link available on the Town

of Westlock website, www.westlock.ca).

• After-hours drop box located outside

the Town Office in Westlock.

• The Town also has a monthly Tax

Installment Payment Plan by direct

debit from your bank account. If you are

interested in this option or have

any questions regarding your tax

account, please call the Town Office at

780-349-4444.

FORWARD PAYMENT AND DIRECT

INQUIRIES TO THE TOWN OF

WESTLOCK,10003-106 STREET,

WESTLOCK, AB, T7P 2K3.